What is A Hedge Fund? Key Differences Between Hedge Funds and Private Equity

Hedge funds are an example of private equity. These funds are traditionally utilized by institutional investors to have access to a wider range of and sophisticated strategies for investing than they can use other investment products available that are available. There are several important distinctions between hedge funds as well as private equity function and how private equity works, which you can read on in the following article.

What is A Hedge Fund?

An investment instrument called a hedge fund pools the capital of a small number of investors. It invests in a wide range of investments, such as bonds, stocks commodities, derivatives, and stocks. The majority of hedge funds are run by experienced money managers who employ a range of strategies that generate the best returns on behalf of their clients. The hedge funds are different with private equity a number of important ways.

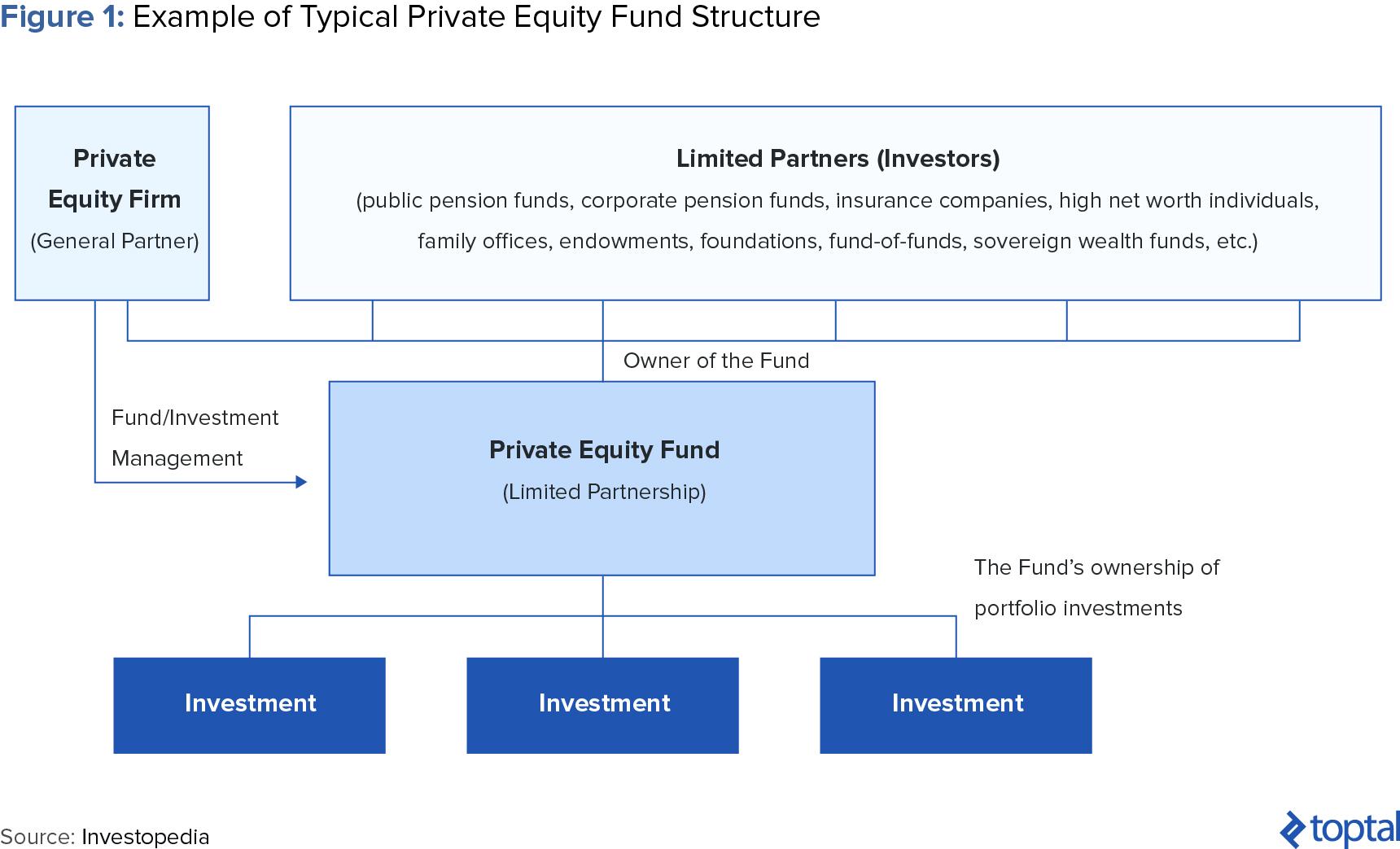

First they are generally open-ended, which means that they are able to accept new capital for investment continuously. Private equity funds however tend to be closed-ended entities that will only take new capital during a certain fundraising period. In addition hedge funds are usually constructed into partnerships. This permits the fund’s administrators be a part of the gains (and losses) that the fund generates. Private equity fund are usually organized as corporations, meaning that fund managers are not a part of the gains or losses made from the fund.

In addition, hedge funds generally have shorter investment horizons that private equity ones. The managers of hedge funds typically seek to make returns over months or even years, whereas manager of funds that are private typically prefer to make profits over years or even decades. Fourth hedge funds are more focused on the financial engineering aspect and market timing more than the private equity fund. The managers of hedge funds typically employ sophisticated methods and instruments to earn returns regardless of the market’s conditions. Fund managers who manage private equity typically adopt a long-term perspective and concentrate on identifying and investing into firms with solid foundations.

Different types of Hedge Funds

There are four types of hedge funds.

1. Equity hedge funds They invest in stocks, whether through short or long positions or a mix of both. They are designed to earn money regardless of whether the market is moving either way or the other.

2. Funds that are event-oriented concentrate on events that affect corporations, such as mergers, bankruptcies and acquisitions. They attempt to profit from price fluctuations caused by these events. occur.

3. The funds make bets on economic indicators , such as inflation, interest rates and exchange rates for currency. They seek to make money from their forecasts of the economic trend.

4. Funds that are based on relative value aim to gain from pricing differences between the markets for various financial assets. For example, they may purchase a bond and then sell another bond that has more interest and bet that the cost of the bond they purchased will rise as the interest rate on the second bond drops.

Who is Invested in Hedge Funds?

An investment instrument called a hedge fund pooled funds from a select group of investors. They invest in a range of investments, such as commodities, bonds, stocks and derivatives. The majority of hedge funds are run by experienced money managers who use different strategies to earn profits to their shareholders. Private equity firms, on the contrary they are investment firms which raise funds from a select group of shareholders and then invest the money into privately-owned businesses.

Private equity firms generally are looking to purchase businesses and help them grow and then sell them for the profit. Who is investing into hedge funds? In general hedge funds are accessible to accredited investors, which are individuals or organizations that meet certain requirements set in the U.S. Securities and Exchange Commission (SEC). Individually, that usually involves having an annual earnings of $200,000 or greater ($300,000 in the case of couples) or having a net worth of one million or higher (excluding any value associated with one’s principal residence). Institutions, in this case, generally is an entity that has an assets under supervision (AUM) in the amount of 5 million dollars or greater.

What is the process by which Hedge Funds operate?

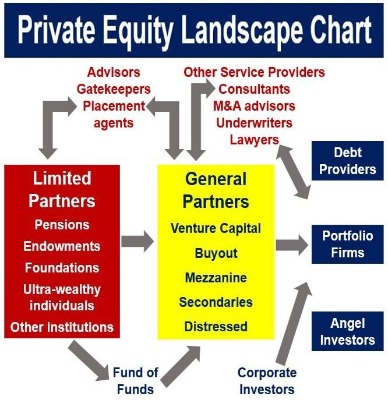

They are usually formed as limited partnerships with general partners (GP) in charge of the fund as well as it’s investment portfolio as well as the limited partners (LPs) making investments in the fund. The GP is typically an registered investment advisor, or a hedge fund management company and the LPs are usually large institutional investors like pension foundations, endowments, fund of funds insurance companies, foundations, and high-net-worth individuals. In the partnership agreements between GP and LPs specifies the conditions of the partnership and includes the management fee paid to the GP and the performance fee paid by the GP in the event that certain benchmarks are achieved.

The majority of hedge funds have higher costs as opposed to traditional asset manager as they claim to offer higher returns. In the typical hedge funds, it works with a small group of investment specialists, headed by the fund manager. A Fund Manager, such as Denvers Tyler Tysdal, will be accountable for making all investments on behalf of the fund. The team includes analysts who conduct extensive analysis of potential investments as well as traders who trade for the fund, as well as personnel who assist in the day-today activities for the funds. Hedge funds employ a range of strategies to earn the best returns to their customers. Some common strategies include long/short equity, global macro, event-driven, and quantitative/statistical arbitrage. hedge funds also have plenty of flexibility in what they do with their portfolios as well as the types of securities they are able to invest in. This flexibility lets hedge funds benefit from opportunities that aren’t readily available.

How to invest in hedge Funds?

If you’re considering investing in the hedge fund market with a hedge fund manager such as Tysdal, there are some points to be aware of. These are instruments for investing that pool funds from accredited investors to invest in various investments generally with the intention of earning a profit. hedge funds are different from private equity funds in a couple of fundamental ways. First, they generally have an open-ended structure, which means that they can take on new capital from investors anytime, while private equity funds are governed by the same timeframe to raise and invest capital.

In addition, hedge fund managers are more flexible in the way they allocate capital and make use of leverage and short sales to increase the returns. If you are interested in making investments in hedge funds you must first talk to a financial adviser to determine whether this type of asset is suitable in your financial portfolio. After that, you should research various hedge funds and talk to the managers to gain more information about their investment strategies. Once you’ve decided on one or two funds you want to work with your financial adviser on the best method to distribute your money.

Risk Factors in Hedge Funds

There are many risks related to hedge fund investments that the investors must be aware of prior making a decision to invest. They include 1. Hedge funds are typically heavily leveraged, and can result in large losses if the market moves against them. 2. They can also be much more unpredictable than many other kinds of investments, which could make them harder to forecast and manage. 3. The majority of hedge funds have high costs, which could reduce any profits that are earned. 4. There is also the potential for fraud and mismanagement because hedge funds aren’t as subject to the same oversight like the other institutions of finance.

The Differentialities Between Private Equity and Hedge Funds

There are some important differences between private equity funds and hedge funds. For instance, private equity firms tend to concentrate on long-term investments, whereas hedge funds are more focused on the short-term. In addition, private equity firms tend to invest in businesses that will help to develop and expand, whereas hedge funds might seeking to earn profits quickly. A further distinction in the private equity sector is that companies generally have a greater amount of funds to work with as opposed to hedge fund. This is due to the fact that private equity firms usually get funding from institutional investors, whereas hedge funds usually depend on private investors. Private equity firms have the ability to make decisions with greater flexibility when it comes to investments. In addition, private equity firms tend to be larger that hedge funds. This is because they typically have greater cap